Financial sector

What is crowdfunding?

Crowdfunding is basically a financing mechanism whereby a large number of backers finance a specific project. In this sense, crowdfunding is not new. There are long-standing traditions of community project financing in Africa, after all. The Harambee events that raise money for social projects in Kenya are one example, the informal sou-sou savings clubs found across West Africa are another.

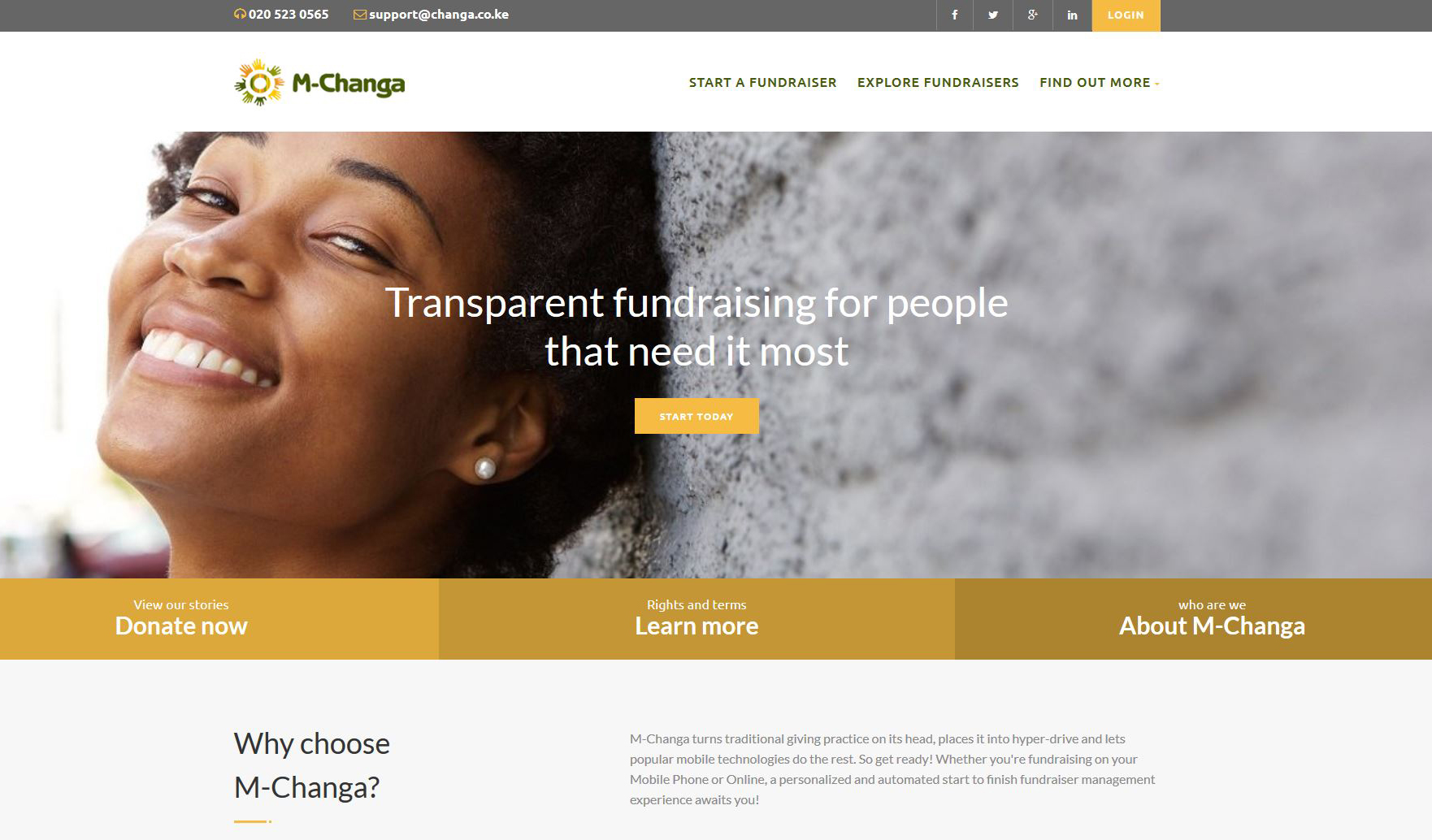

Typical of nowadays crowdfunding is that the projects for which funding is sought are advertised on social media and the internet – with potentially global reach. Moreover, the money is raised by specialised websites. The World Bank has therefore described crowdfunding as an “online extension” of traditional forms of community finance. The range of applications has grown considerably, however. Crowdfunding is used to mobilise money for community, social, charitable and creative purposes, and SMEs are increasingly using crowdfunding as an alternative to bank loans. Start-ups in particular tend to rely on crowdfunding.

Four basic types of crowdfunding are defined by what backers receive in return:

- Donation-based crowdfunding: backers support a project financially for civic or philanthropic reasons with no expectations of a reward. This is basically fundraising for non-profit organisations.

- Rewards-based crowdfunding: backers receive a non-monetary reward for their financial support. The consideration typically is part of project output and is graded according to the level of financial contribution. For SME financing, rewards-based crowdfunding can be an interesting pre-sale instrument: a fixed sum is paid for the development and manufacture of the product, which the backer then receives.

- Lending-based crowdfunding: investors make their financial contribution in the form of a loan. On maturity, they are paid back the principal plus interest at an agreed rate. In its functioning, crowd lending resembles conventional bank lending.

- Equity-based crowdfunding: crowd investors provide equity-funding for an enterprise; what they receive in return depends on the nature of their investment. A basic distinction is made between two types: equity investors either acquire shares in the enterprise, or they provide equity-like loans that bear interest (“mezzanine capital”).