Asia

Multilateral banks honeymoon

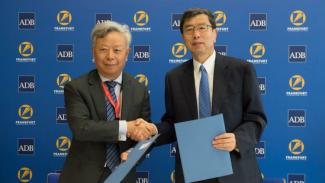

Takehiko Nakao, the ADB president, said that the details of the deal had not been agreed yet, but that both multilateral institutions will invest the same amount. According to him, up to $ 300 million are at stake. The ADB will manage things on the ground, given that the AIIB only began operations last year and does not have an extensive network of country offices yet. According to Nakao, ADB rules and standards will apply.

Among western donor governments, the AIIB is a controversial institution. The US administration considers it an instrument of Chinese policymaking and wanted its allies to reject Beijing’s invitation to join it. Major EU countries, including Germany, became members nonetheless, arguing that they wanted to influence the new institution from within and tie China more firmly into the system of global governance.

Jin Liqun, the president of the AIIB, took part in the ADB conference in Frankfurt. He used the occasion to emphasise that all sides benefit from cooperation. The road project in Pakistan is an example. Better transport infrastructure will obviously benefit Pakistan’s economy. At the same time, the intended co-financing fits into what Beijing calls the “One Belt One Road” programme, which is meant to improve sea links in the Pacific and Indian Oceans and to rebuild something like the ancient silk road. Such infrastructure would boost Chinese exports, and Chinese companies can get assignments building it.

Common interests

Jin correctly points out, however, that the One Belt One Road initiative does not merely serve Chinese interests, insisting that the policy was launched by the People’s Republic, but is not owned by it. In his eyes, the owners are the countries that get the new infrastructure. It is true, of course, that, if Pakistan’s road links to western China improve, not only people there will get better access to Pakistan’s seaports. So will people in land-locked Central Asian countries with links to China. All summed up, world trade would become easier.

Jin is happy to point out shortcomings of global development. In his assessment, the least developed countries are being left behind, not least because they cannot afford loans from multilateral banks to build essential infrastructure. He proposes that all multilateral banks get together and think outside the box to improve matters. In Frankfurt, however, he did not comment on a proposal made by Norbert Kloppenburg, a board member of Germany’s KfW Banking Group. According to Kloppenburg, it would make sense to grant very poor countries loans denominated in their own currencies so they would not bear any exchange-rate risks.

Rather than delve deeply into specifics, Jin expressed a general interest in cooperation in Frankfurt. His counterpart at the ADB similarly showed himself open to joint action. Nakao reported that the ADB was planning further to do co-financing with the AIIB as well as discussing joint projects with the Shanghai-based New Development Bank (NDB), which, like the AIIB, was launched last year. It is owned by Brazil, Russia, India, China and South Africa (BRICS).

Beijing’s foreign policy stance

Whether the current honeymoon between the new and the established multilateral development banks will last remains to be seen. According to a German government officer, cooperation with the new multilateral banks may yet become “very difficult” in spite of the promising start. It is evident, for instance, that Jin endorses Beijing’s foreign-policy stance. Asked whether tensions in the South China Sea, where the People’s Republic is building airstrips on islands that are also claimed by other nations, could hurt economic cooperation, he responds that China’s approach is consistent: it wants difficult issues of sovereignty to be resolved “amicably”.

Statements like this make some observers flinch. Building militarily relevant airstrips is not exactly amicable after all. In regard to development affairs, moreover, there are marked differences between the approaches taken by established donors and emerging markets. The former want governance to improve, human rights to be respected and sustainability principles to apply. The latter, in contrast, are more interested in unrestricted economic growth. The Indian government, for instance, is pressing ahead with projects disregarding the ecology and marginalised people. The emerging markets want more say in the management of multilateral development banks and have recently been providing more capital to the ADB.

For decades, on the other hand, civil-society activists have been accusing multilateral development banks of harming poor people and the environment. Today, however, many of them worry that the progress made towards serious social and environmental safeguards will be undone as established development banks compete with the new ones for business (see box). While non-governmental organisations still see many contentious issues in regard to established IFIs, they have even less trust in the BRICS and the development banks they have launched.

ILO norms

Gerd Müller, Germany’s federal minister for economic cooperation and development, is known to support many causes promoted by civil-society organisations. At the ADB’s annual meeting, he presented the Frankfurt Declaration that was agreed by Germany and the ADB. It includes commitments to climate protection and adaptation as well as to professional and vocational training. According to Müller, it does not make sense to build infrastructure without enabling the young generation to find good jobs.

In a similar vein, he praised the ADB and the World Bank for making observance of the International Labour Organisation’s core labour norms a condition for granting loans. Germany promoted the cause, and doing so is probably easier in the context of the established international financial institutions than the new ones. It also has more impact since the established banks have greater financial clout. The ADB granted loans worth over $ 16 billion last year and expects that figure to rise to $ 20 billion by 2020, says Nakao, while the AIIB probably can invest up to $ 5 billion or so in 2016.

Hans Dembowski