ECOWAS

Mere first steps

President Emmanuel Macron of France visited his Ivorian counterpart Alassane Ouattara in Abidjan. Shortly before Christmas, they announced the end of the CFA Franc and said it would be replaced by a new currency called Eco. The CFA Franc has been legal tender in former French colonies for almost 75 years now.

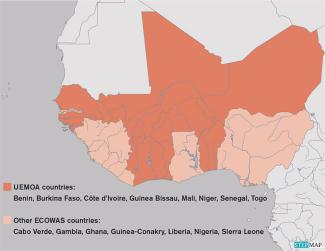

The CFA exchange rate is pegged to the Euro and was previously moored to the French Franc. It is managed by two monetary unions: UEMOA (Union Economique et Monétaire Ouest Africaine) in West Africa and CEMAC (Communauté Economique et Monétaire de l’Afrique Centrale) in Central Africa. The reforms announced in December only concern UEMOA, but similar steps are expected for CEMAC as well. The UEMOA’s central bank is based in Dakar. It has eight member countries, including Lusophone Guinea Bissau. Guinea-Conakry, a former French colony, is not an UEMOA member however.

The CFA Franc has long been controversial. On the upside, the peg to the Euro ensures a stable exchange rate internationally. The big problem, however, is that this exchange rate reflects the European economy. For African exporters, it is overrated. Commodity exports are feasible, but it is very hard to add value. Other points of contention are that member countries had to keep half of their foreign exchange reserves in France, and that a French board member takes part in central bank decisionmaking.

According to Macron and Ouattara, the last two points are set to change. For-ex reserves will no longer have to be deposited in France and France will no longer have a board member. To some extent, the Eco would thus give the UEMOA more policy space. The peg would remain, however, and that is not acceptable, according to Demba Mossa Dembélé, an economist from Senegal: “We cannot keep the Eco pegged to the Euro on a fixed exchange rate basis and pretend that we are independent.”

Financial investors, moreover, doubt that France will keep the pledge to guarantee the exchange rate in times of crisis. Currency pegs have often led to financial turmoil. That happens when an exchange rate diverges substantially from a currency’s true domestic value. High debt burdens are particularly dangerous.

These are things that the members of UEMOA must consider. The reforms that Macron and Ouattara announced point in a sensible direction, but considerable restrictions would remain. African policy-makers should consider more reforms.

However, Macron and Ouattara indicated that their project is about more than merely replacing the CFA Franc with something new. They suggested that the Eco should become the common currency of all members of ECOWAS (Economic Community of West African States), to which several Anglophone countries belong too.

Zainab Ahmed, Nigeria’s finance minister, has slammed the Abidjan announcement. She pointed out that it does not reflect ECOWAS decisionmaking.

There actually have long been plans to establish a joint currency for ECOWAS, but the project has never really taken off. Several issues would need to be dealt with first, including very basic things such as convergence criteria for membership and a harmonised system of economic statistics. Nigeria wants a region-wide customs union to be established prior to the creation of the new single currency.

Moreover, there is no reason why governments of Anglophone countries should want to adopt a currency in which France is still a major stakeholder. The name Eco adds to the controversy, since it consists of the first letters of the acronym ECOWAS.

Karim Okanla is a media scholar and freelance author based in Benin.

karimokanla@yahoo.com