Impact investing

How to convince rich people to use their money for good

The dramatic rise in global inequality is not a new story. When Forbes began tracking billionaires in 1987, there were 140. Today, there are 3,028 – including 247 new entrants in the past year alone. Together, these billionaires sit on a combined fortune of $ 16.1 trillion. The richest 1.5 % of people now hold 48 % of global wealth.

Throughout history, humanity has never seen so few hold so much. Their assets would be more than enough to finance transformative global change – from addressing climate change to ending hunger and extreme poverty – while still leaving them extraordinarily wealthy. Yet rather than seeing investments in sustainability grow, we are witnessing the opposite. In 2024, investors withdrew almost $ 20 billion from US-based sustainable funds, and fundraising for environmental and social causes remains sluggish.

This begs the question of why the financial elite are not using their immense resources to make the world a better place. What holds the wealthiest back from pursuing a legacy of positive impact rather than accumulation?

Sustainable development will not be achieved unless impact investment takes on a far more prominent role. The challenges facing humanity are too great for governments or NGOs to tackle alone. The private sector must contribute by funding scalable solutions that balance profitability with social and environmental responsibility.

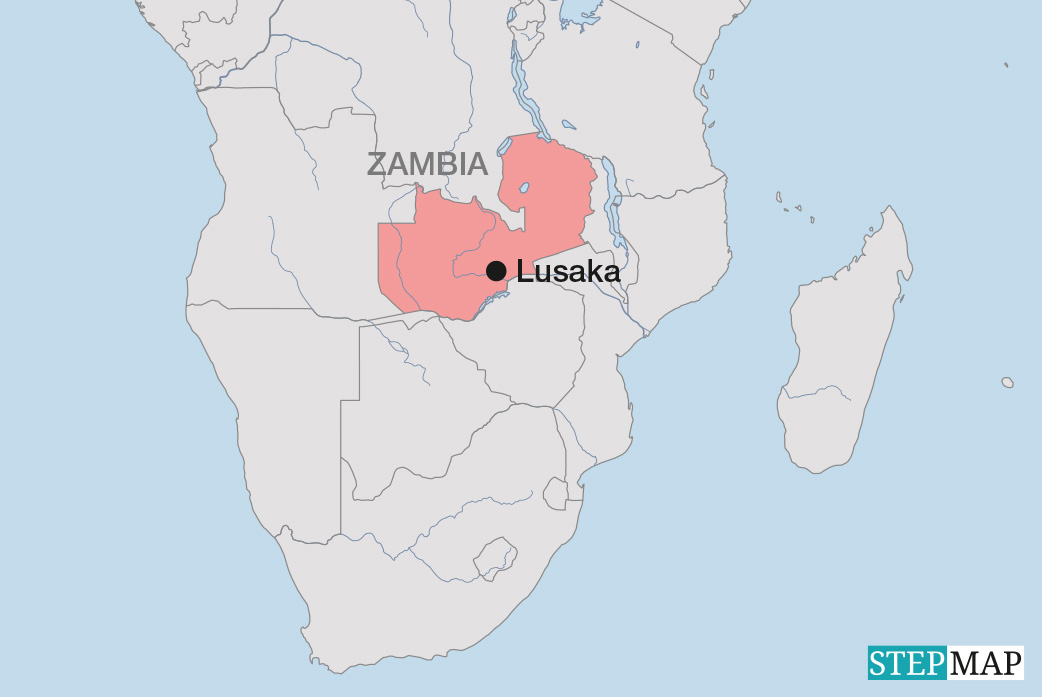

This is the core idea behind impact investing. It seeks to channel capital towards enterprises that deliver both financial returns and measurable benefits for people and the planet. Companies such as Goodwell Investments, where I work, invest for example in early-stage African companies that provide underserved populations with essential goods and services.

Barriers to impact investing

Impact investing seems like a win-win proposition: it is both responsible and profitable, advancing sustainability and social inclusion. Yet many wealthy individuals hesitate to engage. Their reluctance stems from a combination of structural and psychological barriers.

The psychology of wealth is very complex. Money represents freedom, opportunity and security. Preserving these liberties for oneself and future generations is a deeply human instinct. And as wealth accumulates, so does the desire to protect it. Many high-net-worth individuals therefore focus more on safeguarding their assets than on deploying them for social or environmental impact.

The next obstacle many high-net-worth investors encounter is their own wealth managers, who act as gatekeepers of capital. Even when clients express interest, advisers seldom propose impact-investment options. In fact, it is often the investors themselves who bring such opportunities to their managers’ attention – not the other way around.

Financial advisers tend to emphasise risk and steer clients towards conventional, low-volatility portfolios. This reinforces the herd mentality financial markets are known for. Although some impact-investment advocates within financial institutions are working to change this mindset, they remain exceptions rather than the rule.

Impact investing also requires a particular mindset – one shaped by the way in which an investor accumulated their wealth. Do they see themselves as entrepreneurs? Which social or environmental issues resonate with them? What kind of legacy do they want to leave? For high-net-worth individuals, reflecting on such questions can provide the foundation for an entire investment strategy.

An impact-oriented mindset also means recognising privilege: the ability to accept limited liquidity and longer investment horizons in exchange for meaningful social and environmental returns.

Barriers to impact investing in Africa

These general barriers are only the first hurdles in a much longer race. New impact investors tend to stay within their comfort zones, focusing on risk mitigation rather than on creating measurable impact. Clean energy or digital technology are often seen as “safe” sectors.

When it comes to impact investing in Africa, those barriers become even more pronounced. Investing in the continent is still perceived as a second or even third step in an impact investor’s journey – something to consider later, if at all. Without any personal or professional connection to the continent, many investors shy away. In doing so, they miss out on significant opportunities for both financial returns and transformative social impact.

The lack of personal connection is a real challenge. African investors are gradually increasing their share of investments on the continent. In 2024, the African Private Capital Association stated that 31 % of active venture capital investors were African, making them the continent’s single largest investment group. But to a lot of international investors, Africa feels far away. They often lack reliable information about opportunities on the continent – especially if their financial advisers fail to present them. Outdated perceptions persist, obscuring the entrepreneurial dynamism, the booming tech scene, the fast-growing population and the strong business potential that Africa offers.

This is one reason why focusing on companies that provide essential goods and services makes particular sense. Such investments create tangible social impact on the ground while offering investors accessible and resilient opportunities – ventures that can weather crises and still deliver sustainable returns.

Changing mindsets

Financial and social returns can help shift investors’ perceptions – away from viewing impact investments as charitable donations to recognising them as meaningful, long-term capital commitments. The main challenge, however, is to get them to take that first step.

Building relationships with impact-minded investors is crucial. These are individuals who may have personal ties to a particular region or sector, or who are driven by a strong interest in specific social or environmental issues. Trust and a sense of shared purpose are essential; without them, wealthy investors are unlikely to venture into unfamiliar territory.

Fund managers also have an educational role to play. They must make it clear that impact investing is not philanthropy but investment – with financial discipline, measurable results and a clear focus on both profit and purpose. From there, the emphasis should shift from perceived risk to demonstrated impact. That is the key to convincing more wealthy investors to commit their capital where it can truly make a difference.

The next step is to make investing easier. Mechanisms such as co-investment models, guarantees and blended-finance structures can help reduce perceived risk and make the first commitment feel less like a leap into the unknown. Instruments such as first-loss capital, outcome-based financing, revenue-sharing models and guarantees from development finance institutions should all be part of this “mindset toolkit”.

Equally important is the power of direct experience. Reading about a promising venture in Nigeria or Uganda is one thing; meeting the entrepreneurs and seeing the positive impact of their work is quite another. Field visits can transform abstract ideas into tangible conviction.

When engaging with investors, it is crucial to present Africa as a continent of opportunity, not charity. This should happen through concrete data and proven success stories, where investments have delivered both measurable impact and competitive financial returns. The outdated narrative of “helping the poor” must give way to one of “partnering with innovators”.

Despite today’s economic uncertainty, there are many reasons to be optimistic about the future of impact investing. According to PwC, family offices were responsible for 54 % of global impact investment deal volume in 2024. A family office is a company that manages the private wealth of a single family. In the US, an increasing number of these offices are adopting an impact-only approach. As millennials and younger generations assume greater responsibility for wealth management, their investment priorities are more strongly shaped by social and environmental considerations. Once convinced, they often influence older generations to follow suit. In general, it can be said that if the first investment proves successful, trust grows. Positive financial and social outcomes can turn wealthy investors into active advocates, encouraging their peers to also “do well by doing good”.

Nico Blaauw is partner at Goodwell Investments and responsible for Investor Relations and Marketing, Communications and Communities.

contact@goodwell.nl