Financial cooperation

More money for development

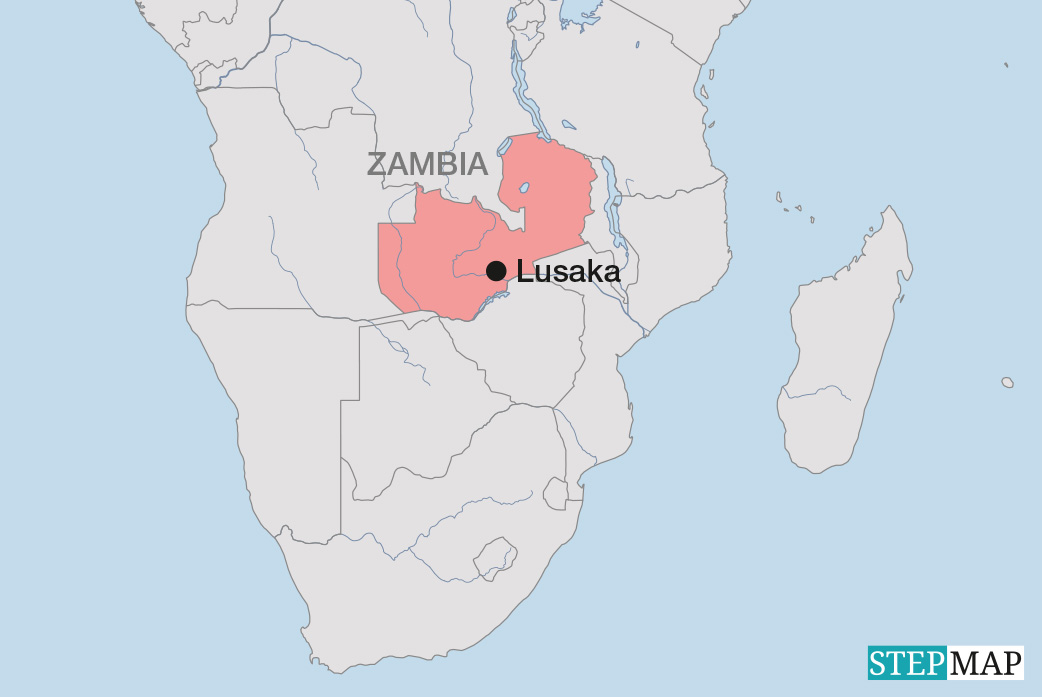

Almost 40 % of the total sum, about € 3.7 billion, will be used for projects in Sub-Saharan Africa, North Africa and the Middle East. Projects in these regions are among the main drivers of commitment growth. KfW is increasingly involved in supporting peace and implementing measures to “fight the root causes of flight”. Last year, the bank’s focal areas were peace and security, vocational training and employment, and climate and environmental protection.

Recently, support to refugees has become an important part of KfW’s work. The bank currently spends more than € 3 billion on 117 projects related to refugees in 28 countries. In a conversation with the press, Joachim Nagel, a member of KfW’s executive board, spoke about the Zaatari refugee camp in Jordan. About 78,000 Syrian refugees currently live there. “Young people in those camps need jobs,” he says. KfW projects support the camp in terms of water and electricity infrastructure as well as educational programmes.

In fragile contexts, donors need to provide basic physical and social infrastructure in a fast and efficient manner. However, bureaucratic processes often slow down implementation. According to Nagel, discussions with Germany’s Federal Ministry for Economic Cooperation and Development (Bundesministerium für wirtschaftliche Zusammenarbeit und Entwicklung – BMZ) are underway to facilitate more efficient procedures in emergency situations. He appreciates that development cooperation has gained traction in German public discourse.

KfW aims to act in a sustainable manner, including in its development efforts abroad. More than half of the money committed to projects in developing countries and emerging markets was earmarked for climate purposes and environmental protection. “This share is high compared to other donors,” says Nagel. “The commitments made in 2017 will help to reduce carbon emissions by 13.7 million tons.”

The bank wants to expand its climate-related projects with an eye to reducing emissions even further. For example, it intends to increase its funding of forest protection and renewable energies. Additionally, KfW has set up the InsuResilience Solutions Fund in support of the InsuResilience Initiative, which was launched last year at the UN climate summit in Bonn. The goal is to support the development of innovative insurance products in regard to climate risks. The ambition is to insure 400 million poor and vulnerable people in developing countries (also see Chinedu Moghalu in D+C/E+Z e-Paper 2018/07, p. 23).

Nagel addressed the recent discussion on sexual abuse in the aid sector. “I take the issue very seriously,” he emphasises. “We have investigated the problem internally, and there have not been any cases related to KfW.” He says the bank will introduce additional training measures to ensure employee’s compliance with the institution’s code of conduct.

Increasingly, German development agencies try to harness digital technologies for development. DEG, a subsidiary of KfW, is concerned with private sector development in developing and emerging-market countries. “In 2018 we want to focus even more on supporting our partners in implementing innovative business models including digital technologies, for example FinTech (financial technologies) or eLearning,” said Christiane Laibach, chairwoman of DEG’s management board.

At the beginning of this year, DEG invested € 4 million in a mobile money technology provider in Ethiopia. M-BIRR, similar to Kenya’s M-Pesa, is a cashless money transfer and payment service that enables users to pay by mobile phone. DEG also supports German small and medium-sized enterprises (SMEs) with investing in developing and emerging-market countries. They have set up “German Desks” with partner banks in Nigeria, Kenya, Bangladesh, Indonesia and Peru. To facilitate investments, a bank employee helps German SMEs and their local partners with banking services and financing opportunities.